what gifts qualify for the annual exclusion

Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient. In addition to these.

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

My client has a problem.

. She has a 4 million estate and wishes to reduce it to the extent possible using gifts that qualify for the annual exclusion. In 2018 each person has a lifetime gift tax exemption of 11180000 and a lifetime generation-skipping transfer GST tax exemption amount of 11180000. This is currently set as 1206 million per donor in 2022.

Gifts are subject to a federal tax but an exemption is available to shelter cumulative gifts within the threshold currently 5490000. Under the IRC a transfer is not a. In addition to these.

Throughout the year you likely give gifts to family and friends for many different reasons. However some gifts are outside the taxs scope including. The federal government imposes a tax on gifts.

While most of these gifts are simple and require no action on your part as it pertains to the IRS more. 2503 an annual exclusion is allowed for taxable gifts the amount of which as adjusted for inflation was 12000 in 2007. Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minors Trust under Internal Revenue Code Section 2503c or has certain temporary withdrawal.

The transfer tax system all lifetime gifts and bequests made at the time of death that exceed certain dollar thresholds are subject to gift and inheritance tax rates of up to 40. Minors Trust under Section 2503 c. Nevertheless certain terms must be included in the trust instrument if gifts to the trust will qualify for the annual exclusion.

In addition to the lifetime gift and estate tax. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each. The recipient must be granted immediate and unrestricted use possession or enjoyment of the.

An annual exclusion gift is one that is below a certain dollar amount so that qualifies it to be excluded from federal gift taxes in a given year. For the 2021 tax year the limit. Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minors Trust under Internal Revenue Code Section 2503c or has certain temporary withdrawal.

Funding the SLAT Such gifts are excluded from gift tax only if they are gifts with present interest meaning that the recipient. Itll also limit the donor to 20000 annual exclusion. The basic exclusion amount is a combined lifetime gift and estate tax exemption.

In 2018 each person has a lifetime gift tax exemption of 11180000 and a lifetime generation-skipping transfer GST tax exemption amount of 11180000. However the annual exclusion is available only for. Under Internal Revenue Code IRC Section.

Do gifts to a slat qualify for the annual exclusion. Only gifts with a present interest qualify for the annual gift tax exclusion. Annual Exclusion Gifts.

An annual exclusion gift qualifies for the 16000 per person per year exemption from federal gift taxes in 2022.

Tax And Legal Issues Arising In Connection With The Preparation Of The Federal Gift Tax Return Form 709 Treatise Law Offices Of David L Silverman

The Generation Skipping Transfer Tax A Quick Guide

Is An Annual Exclusion Gift On Your List Scolaro Fetter Grizanti Mcgough P C

Gifts In Excess Of The Annual Exclusion Grim Law

Faq Is Tuition Exempt From The Gift Tax Estate And Probate Legal Group

Planning For Year End Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

Make Gifts That Your Family Will Love But The Irs Won T Tax Henderson Franklin Starnes Holt P A

Gift Tax Exclusion For Payment Of Qualifying Medical And Tuition Expenses Home Washington Law Firm Stokes Lawrence

Planning For Year End Gifts With The Gift Tax Annual Exclusion Somerset Cpas And Advisors

How To Give Effective Crummey Notices So Gifts To Trusts Qualify For The Annual Exclusion Succession Advisors

Gift Tax Return Tips And Traps Youtube

Irrevocable Trusts And Crummey Powers Shah Associates P C Estate Planning Elder Law Blog

Gift Tax Annual Exclusion Ppt Download

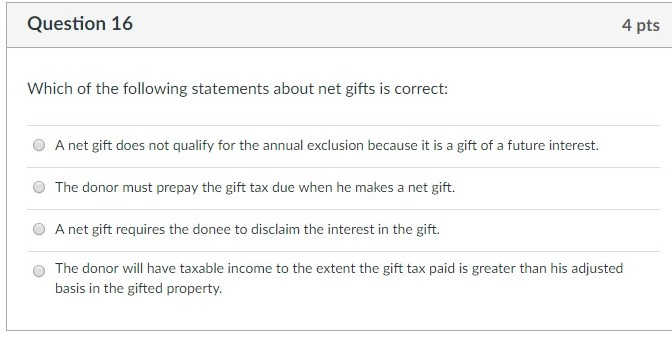

Solved Question 16 4 Pts Which Of The Following Statements Chegg Com

:max_bytes(150000):strip_icc()/christmas-cash--wad-of-american-currency-tied-with-red-ribbon-611319628-ab2093a9addf4a46b6a54817e5eaee21.jpg)